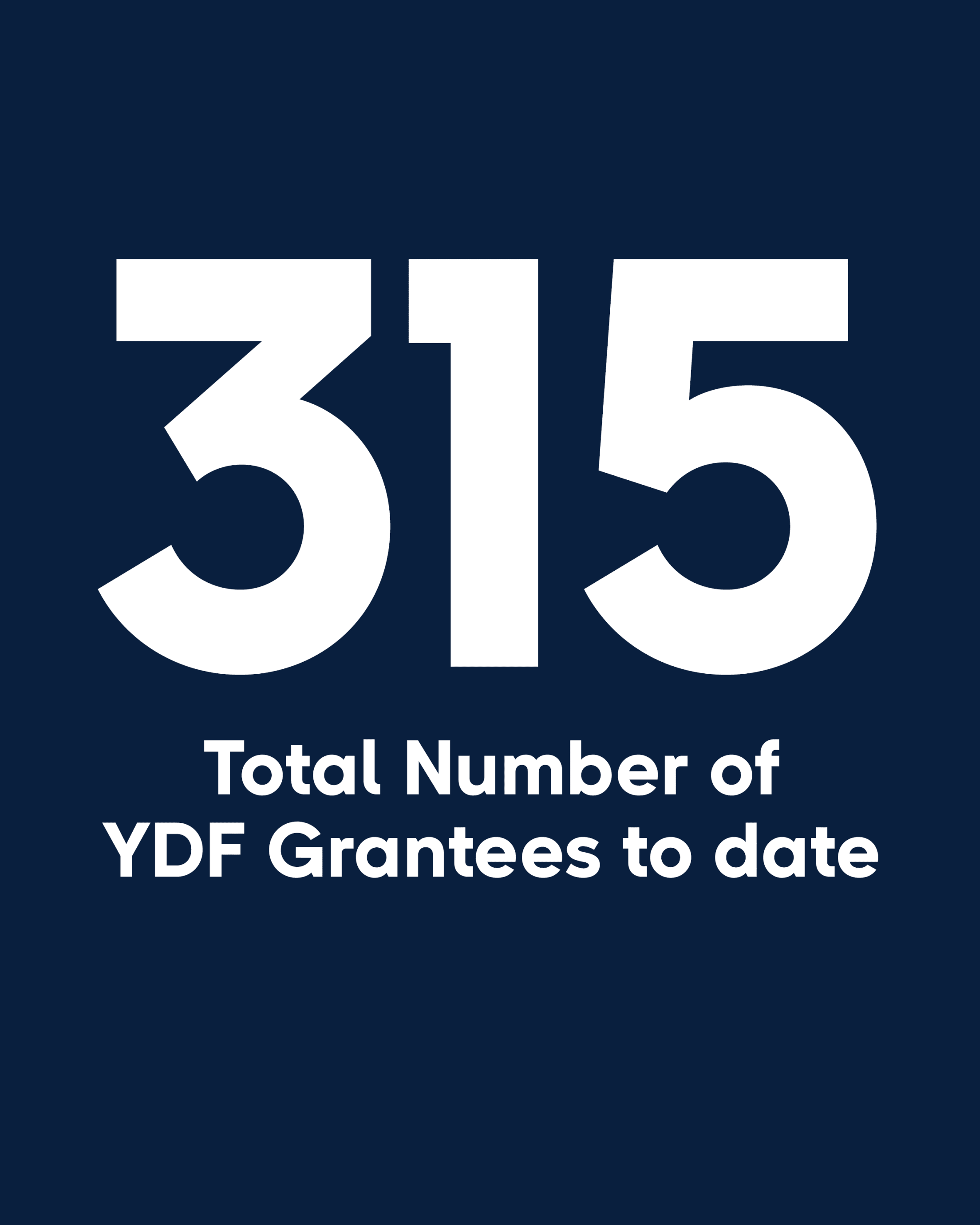

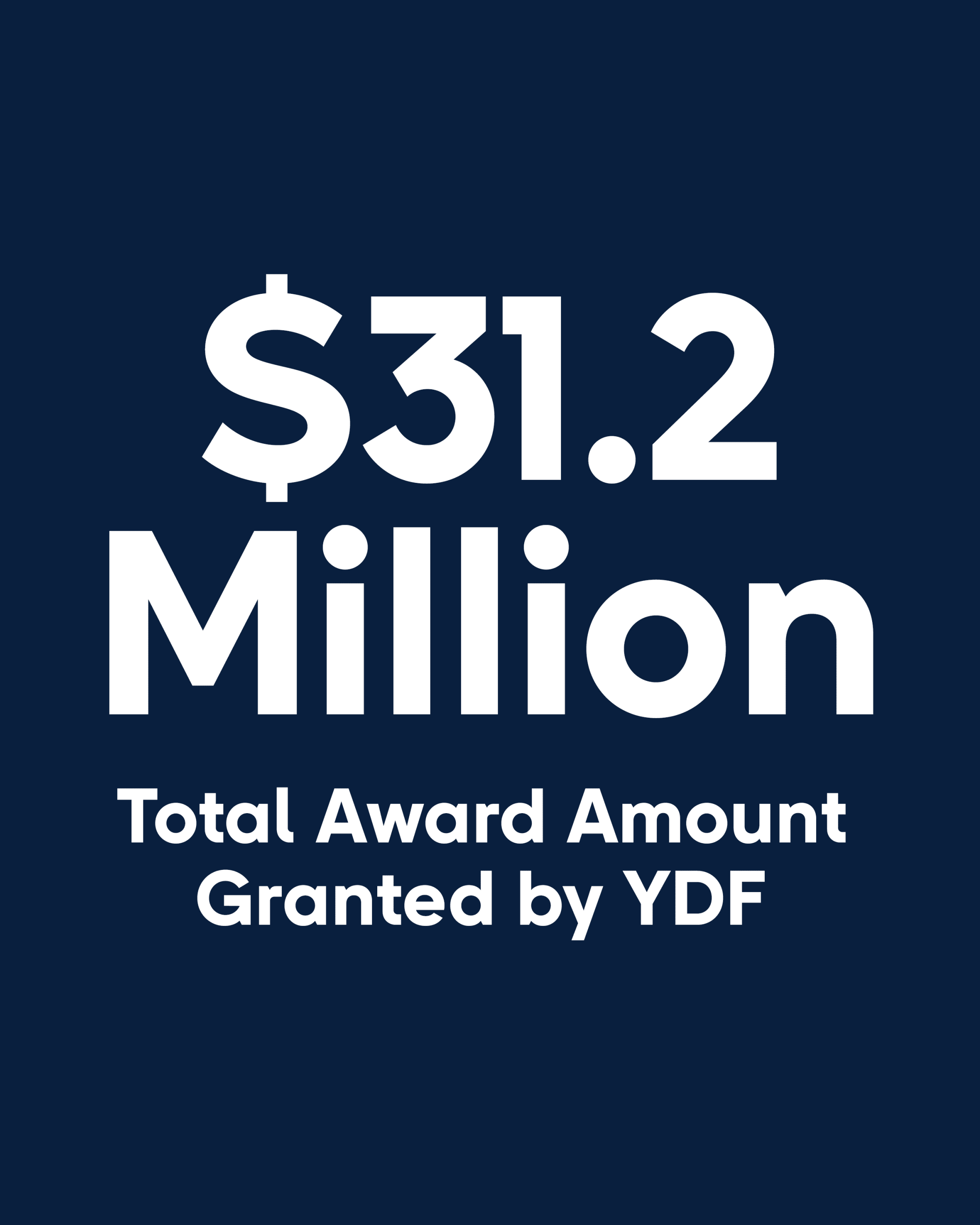

MLB-MLBPA Youth Development Foundation (YDF) is a joint initiative by MLB and MLBPA to support efforts that focus on improving the caliber, effectiveness and availability of amateur baseball and softball programs across the United States and internationally.